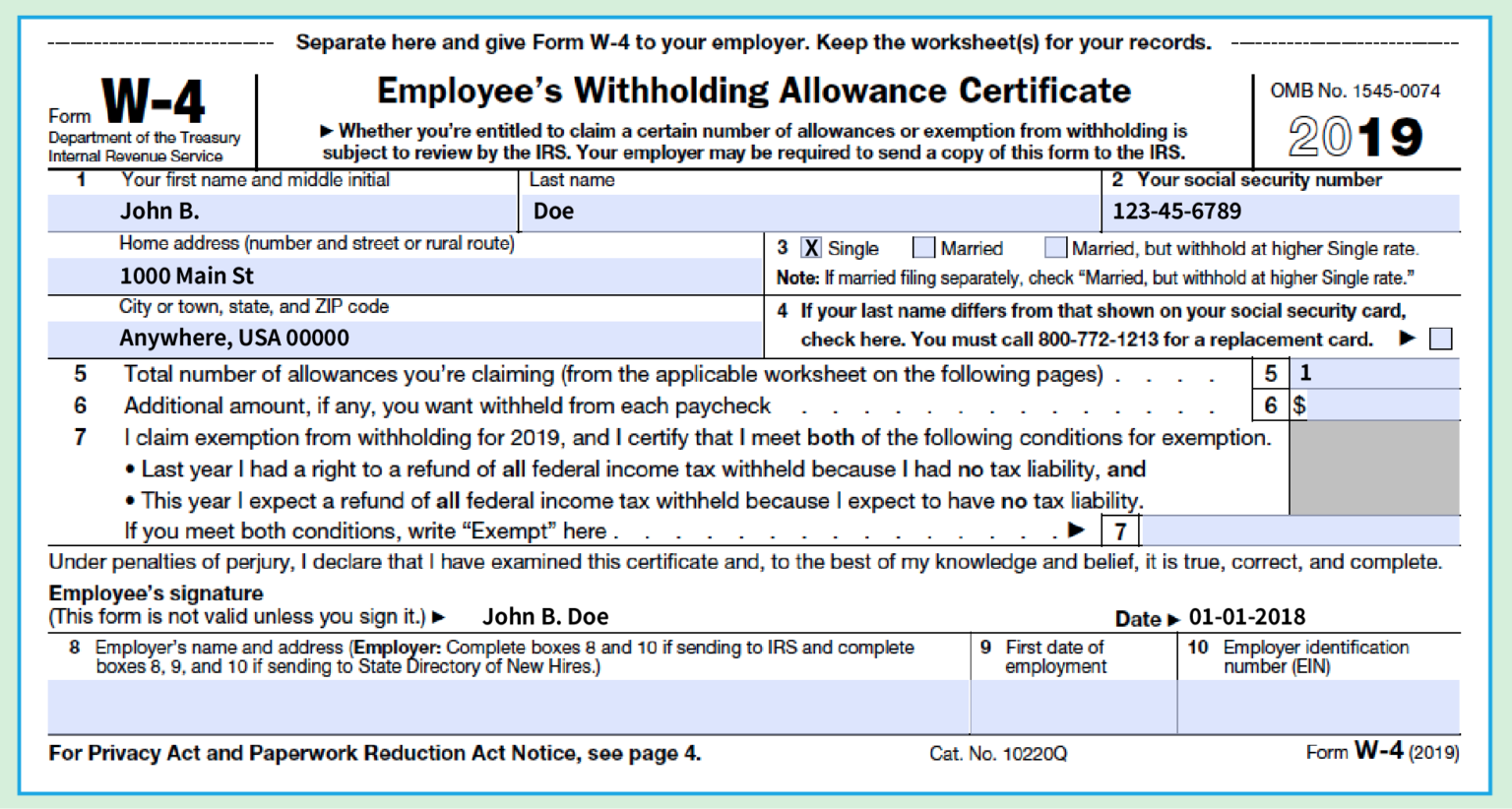

The W-4 form is an essential document that all employees in the United States must complete when starting a new job. It helps determine how much income tax should be withheld from an employee’s paycheck. The Internal Revenue Service (IRS) regularly updates the W-4 form to ensure it aligns with the latest tax laws and regulations.

2020 W-4 Form: What Employers Need to Know

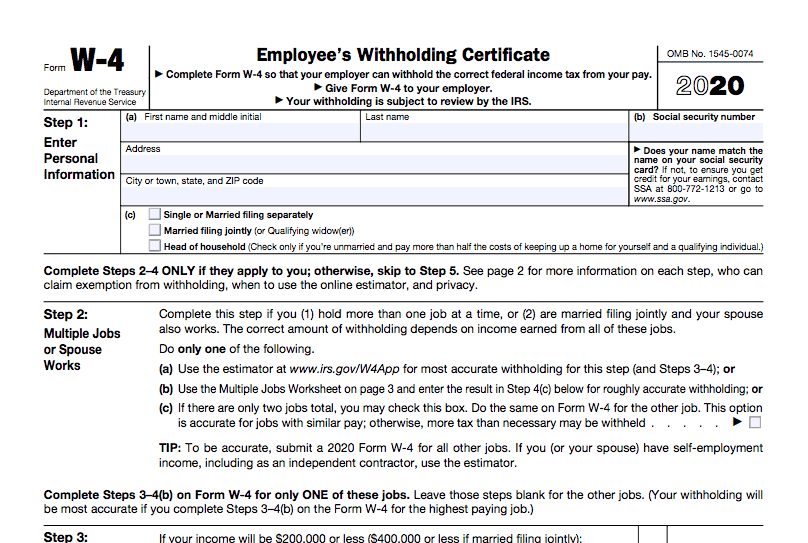

The 2020 W-4 form has been released, and it comes with some significant changes that employers need to be aware of. This new form is designed to make the withholding process more accurate and transparent for both employers and employees. Here are some key points to keep in mind:

The 2020 W-4 form features a simplified layout and eliminates the use of allowances. Instead, employees must provide their filing status, such as single or married filing jointly, and any additional income they expect to earn.

The 2020 W-4 form features a simplified layout and eliminates the use of allowances. Instead, employees must provide their filing status, such as single or married filing jointly, and any additional income they expect to earn.

New W-4 Form for 2020

The Treasury and IRS have unveiled the new W-4 form for 2020, which aims to make it easier for employees to calculate their tax withholding. This new form reflects changes made by the Tax Cuts and Jobs Act and includes step-by-step instructions to help employees determine the correct withholding amount.

The new W-4 form allows employees to account for multiple jobs, dependents, and other tax credit situations. It also provides a checkbox for employees who have a working spouse to account for their combined income.

2020 W-4 Form: Understanding the Changes

If you’re unsure about how the new W-4 form for 2020 works, don’t worry. Alloy Silverstein, a renowned accounting firm, has provided a detailed guide to help you navigate through the changes.

The guide explains the purpose of the W-4 form, how to complete it correctly, and what each section means. It also provides examples and FAQs to address common questions employees may have.

The guide explains the purpose of the W-4 form, how to complete it correctly, and what each section means. It also provides examples and FAQs to address common questions employees may have.

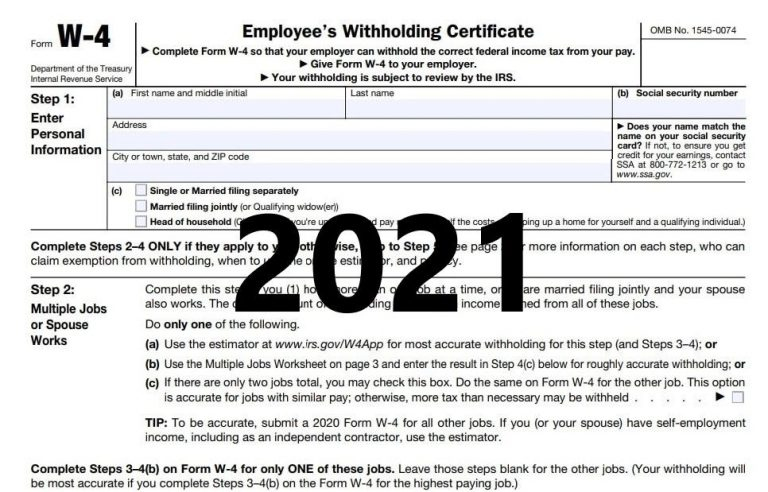

2021 W-4 Form: What You Need to Know

In 2021, there have been some updates to the W-4 form that employees should be aware of. The new form reflects changes related to the COVID-19 pandemic and allows employees to claim the Recovery Rebate Credit if they did not receive the full stimulus payment.

Additionally, the 2021 W-4 form provides increased flexibility for employees with multiple jobs by allowing them to allocate their withholding more accurately.

Additionally, the 2021 W-4 form provides increased flexibility for employees with multiple jobs by allowing them to allocate their withholding more accurately.

Conclusion

Understanding and correctly completing the W-4 form is crucial for every employee. It ensures that the correct amount of taxes is withheld from your paycheck, helping you avoid any unexpected tax bills or penalties. By staying updated on the latest versions of the W-4 form and following the instructions provided, you can ensure that your tax withholding is accurate and in compliance with IRS regulations.

Remember to consult a tax professional or use online resources like the official IRS website for any specific questions or concerns regarding your W-4 form.

Remember to consult a tax professional or use online resources like the official IRS website for any specific questions or concerns regarding your W-4 form.